Giving a Donation of Stock or Mutual Funds

Donating stock can offer you tax benefits while also helping to stop animal suffering. Your gift is mutually beneficial—PETA receives the full value of the stock, while you avoid paying any capital gains tax on appreciated assets.

Tax Benefits of Giving Securities

Giving appreciated securities that have been held for longer than one year can offer significant benefits, including the following:

- You won’t owe capital gains tax on the shares that you donate—and neither will PETA.

- You’ll qualify for an income-tax deduction for the fully appraised value of the stock.

- Similar state tax benefits are also available in most states.

Should you have appreciated stock that you want to keep but are concerned about the capital gains tax that you’ll face when it comes time to sell, donating it to animals could help you. You can choose to donate the stock—thereby avoiding the capital gains—and then use the money that you save with your charitable deduction to buy new shares of the stock at the current, higher-cost basis. Your investment is maintained while you provide a boost to PETA’s vital work for animals.

You should always consult your financial advisor before initiating a charitable contribution.

Donors outside the U.S.: Stock-giving benefits may vary for donors outside the U.S., so be sure to consult your financial advisor before initiating a charitable contribution. If you’re located in Canada, please contact [email protected] to discuss the possibility of donating stock through CAF for a Canadian tax-creditable gift.

How to Donate Stock

The simplest way to donate stock is through an electronic transfer authorization. You can access our transfer details directly for your broker to transfer your securities to PETA.

Access Our Stock-Transfer Instructions

By submitting this form, you’re acknowledging that you have read and agree to our privacy policy and agree to receive e-mails from us.

For questions about this tax-smart way to help animals, please contact:

Deedra Aro

PETA Foundation

757-962-8213

[email protected]

Have you considered naming PETA as a beneficiary of your stock or brokerage accounts? Find out more at PETA.org/Legacy, or e-mail us at [email protected].

Hear from fellow PETA supporters who are helping animals with their generous stock donations:

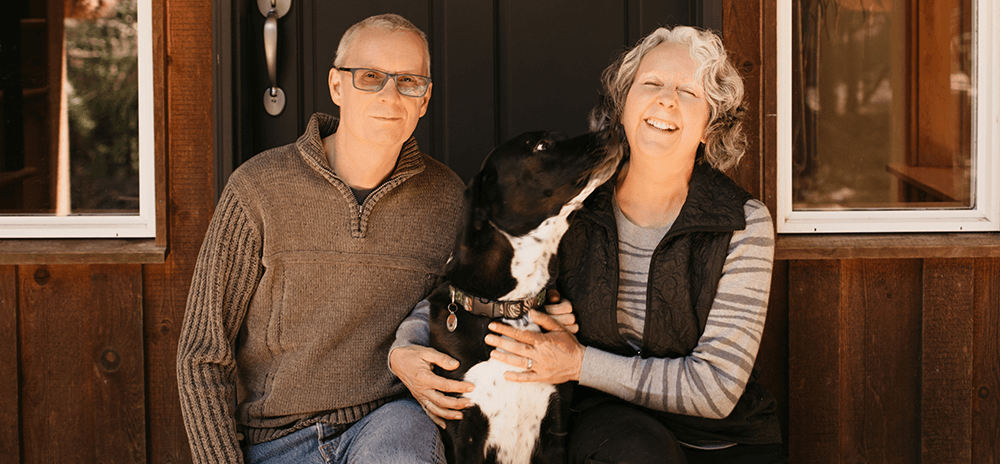

Kathi and David Chorneyko (with Gypsy)

“There is not an organization on this planet that has done more for animals than PETA. PETA is the counterbalance to humanity’s collective entitlement to harm and exploit animals. When we had an unexpected gain from an investment, we were thrilled to learn that rather than triggering capital gains through the disposition of the shares and then donating the funds, it was easy to donate the shares to PETA. By doing so, we were still able to receive the tax benefits of the donation as well the tax advantage of not triggering capital gains. What a great way to help PETA continue the monumental task of shifting our culture toward a kinder, gentler world for animals.”